All Categories

Featured

State Farm agents sell everything from homeowners to car, life, and other popular insurance coverage items. State Farm offers universal, survivorship, and joint universal life insurance policy plans - using iul for retirement.

State Farm life insurance is usually conventional, supplying secure choices for the average American household. If you're looking for the wealth-building opportunities of universal life, State Ranch lacks competitive options.

Yet it doesn't have a strong existence in other monetary items (like universal plans that open up the door for wealth-building). Still, Nationwide life insurance policy plans are highly obtainable to American family members. The application process can likewise be more workable. It helps interested parties obtain their first step with a trusted life insurance policy strategy without the a lot more complex conversations regarding investments, monetary indices, etc.

:max_bytes(150000):strip_icc()/indexed-universal-life-insurance.asp-Final-9f72d52f11d643c693ab8b3600f3cd27.png)

Also if the worst happens and you can not obtain a larger plan, having the security of an Across the country life insurance coverage policy can transform a buyer's end-of-life experience. Insurance policy firms use clinical examinations to evaluate your threat class when applying for life insurance policy.

Purchasers have the alternative to alter rates each month based on life situations. A MassMutual life insurance agent or economic advisor can assist purchasers make strategies with space for modifications to fulfill short-term and long-term financial goals.

Indexed Universal Life Insurance Calculator

Read our MassMutual life insurance policy review. USAA Life Insurance Policy is recognized for offering budget friendly and comprehensive financial products to army members. Some customers may be amazed that it uses its life insurance policy policies to the public. Still, army participants delight in distinct advantages. For instance, your USAA policy comes with a Life Occasion Option motorcyclist.

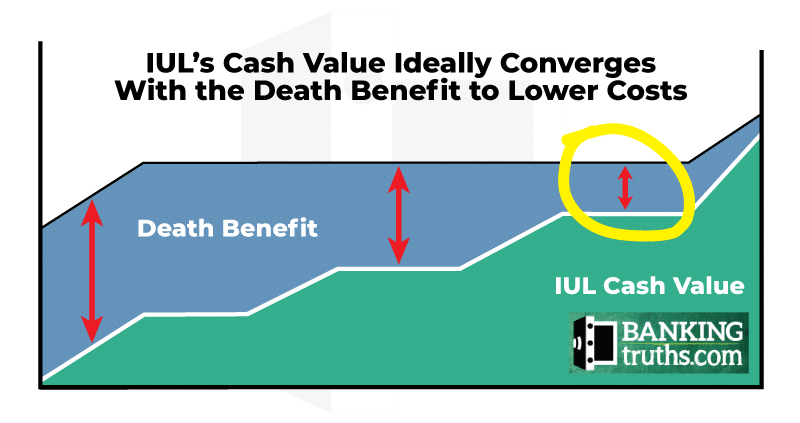

VULs come with the highest possible threat and the most possible gains. If your plan does not have a no-lapse guarantee, you may even shed insurance coverage if your money worth dips listed below a certain limit. With so much riding on your financial investments, VULs call for constant attention and upkeep. Thus, it may not be an excellent choice for individuals that just desire a survivor benefit.

There's a handful of metrics through which you can judge an insurance provider. The J.D. Power customer fulfillment rating is an excellent choice if you want an idea of how consumers like their insurance coverage. AM Ideal's economic stamina rating is another important statistics to think about when choosing a global life insurance policy firm.

This is especially vital, as your cash value grows based upon the investment choices that an insurance coverage business supplies. You ought to see what investment choices your insurance coverage service provider offers and compare it against the objectives you have for your policy. The most effective method to find life insurance is to accumulate quotes from as lots of life insurance policy business as you can to understand what you'll pay with each policy.

Latest Posts

What Is Indexation In Insurance

Difference Between Whole Life Vs Universal Life

Indexed Universal Life Insurance For Retirement